Fica tax calculation 2023

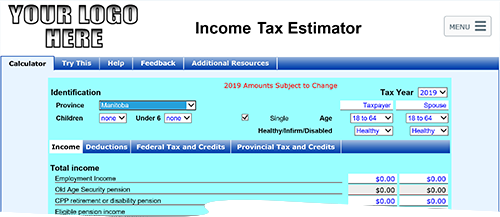

The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. This tab allows you to enter your local county tax rate in Maryland manually so you can have a more refined tax calculation forecast for your tax return in Maryland.

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables.

.png)

. This tax paid by self-employed individuals is known as the SECA or more simply the self-employment tax. When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041. To operate within the strict parameters of the law the administration would be obliged to simply delay benefit payments creating a backlog that grows.

Very similar in the calculation as Social Security tax Medicare deducts 145 of the employees taxable earnings for payment to Medicare. New income code 56 was added to address section 871m transactions resulting from combining transactions under Regulations section 1871-15n including as modified by transition relief under Notice 2020-2. This tab allows you to enter your local county tax rate in Virginia manually so you can have a more refined tax calculation forecast for your tax return in Virginia.

Record Keeping Requirements for Employers at wwwdolgov. The following updates have been applied to the Tax calculator. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year.

Changes to Form 1042-S. The following updates have been applied to the Tax calculator. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

IRS Publication 15-T Federal Income Tax Withholding. Self-Employed defined as a return with a Schedule CC-EZ tax form. State income tax withheld.

A self-employment tax feature. Terms and conditions may vary and are subject to change without notice. Federal Insurance Contributions Act tax FICA.

Updates to the New York State Tax Calculator. Because the FAFSA changes are anticipated to go into effect in 2024 families may want to consider their income information in 2022 and how future changes may impact their planning. Your Income in detail F1040 L7-21.

The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully published as published by the various States. New 2022 Form W-4 - This is the official IRS form - an editable PDF. 1 online tax filing solution for self-employed.

FICA Exempt Income Tax State. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Tax Return Access.

FAQs on the 2020 Form W-4 - Some guidance for using the new 2020 W-4 Form. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only.

15 The Department of Revenue estimated that the increase in the subtraction resulted in a revenue reduction of about 44 million in tax year 2019 and would grow to 53 million in FY 2023. Tax calculations allow for Tax-Deferred Retirement Plan. The following income chapter 3 status and Limitation on benefits LOB codes were added to Form 1042-S.

Section 402c3C was added to the Code by section 13613 of the Tax Cuts and Jobs Act Public Law 115-97 131 Stat. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. After taking 12 tax from that 16775 we are left with 2013 of tax.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. For example FICA taxes are calculated as such. For tax years beginning after 2006 the Small Business and Work Opportunity Tax Act of 2007 Public Law 110-28 provides that a qualified joint venture whose only members are spouses filing a joint income tax return can elect not to be treated as a.

IRS Tax Withholding Assistant - The IRS has created a spreadsheet that can be used to calculate federal tax withholding. However as a freelancer you are both the employer and the employee. Rental price 70 per night.

And grows because. Review W-2 information to determine if taxable wages are less than FICA wages which may indicate the taxpayer has an employer sponsored retirement account 401k or 403b or other non-taxable income. It is not a substitute for the advice of an accountant or other tax professional.

The rate for Medicare lands at 29. Terms and conditions may vary and are subject to change without notice. Paycheck Calculation References.

Americas 1 tax preparation provider. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and. Do not include any amount that is being paid for outstanding state or local tax liabilities in the calculation of the.

Tax calculations allow for Tax-Deferred Retirement Plan. Employers pay a Social Security tax rate of 62 and a Medicare tax rate of 145 as do employees. IRS Publication 15 Employers Tax Guide pdf at wwwirsgov - The official source for information about payroll taxes in the US.

Tax Return Access. 3 Specifically the deadline for rollover of any portion of a QPLO amount is extended so that it ends no earlier than. Your Income in detail F1040 L7-21.

For example the 20222023 FAFSA will be based on income information from the 2020 tax return. Ordering tax forms instructions and publications. To this the employer must match 145 for a total payment of 290.

SECA established that self-employed individuals would be responsible to pay the whole 153 FICA. Social Security tax withheld aka FICA Medicare tax withheld. Updates to the Wisconsin State Tax Calculator.

The second portion of your self-employment tax funds Medicare. The 2019 omnibus tax bill increased the maximum subtraction amounts while slightly reducing the phaseout thresholds. OIC or 433-B OIC.

FICA Exempt Income Tax State. Qualified sick leave wages are wages for social security and Medicare tax purposes determined without regard to the exclusions from the definition of employment under section 3121b1-22 that an employer pays with respect to leave taken after March 31 2020 and before April 1 2021 under the Emergency Paid Sick Leave Act EPSLA as. 145 of your gross income is taken for your Medicare costs taking 580 from you.

While income tax is the largest of the costs many others listed above are taken into account in the calculation. Automatic calculation of taxable social security benefits. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

2054 2017 TCJA to provide an extended rollover deadline for qualified plan loan offset QPLO amounts.

Simple Tax Calculator For 2022 Cloudtax

Manitoba Income Tax Calculator Wowa Ca

Tax Calculators And Forms Current And Previous Tax Years

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Capital Gains Tax Calculator 2022 Casaplorer

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Knowledge Bureau World Class Financial Education

2021 2022 Income Tax Calculator Canada Wowa Ca

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

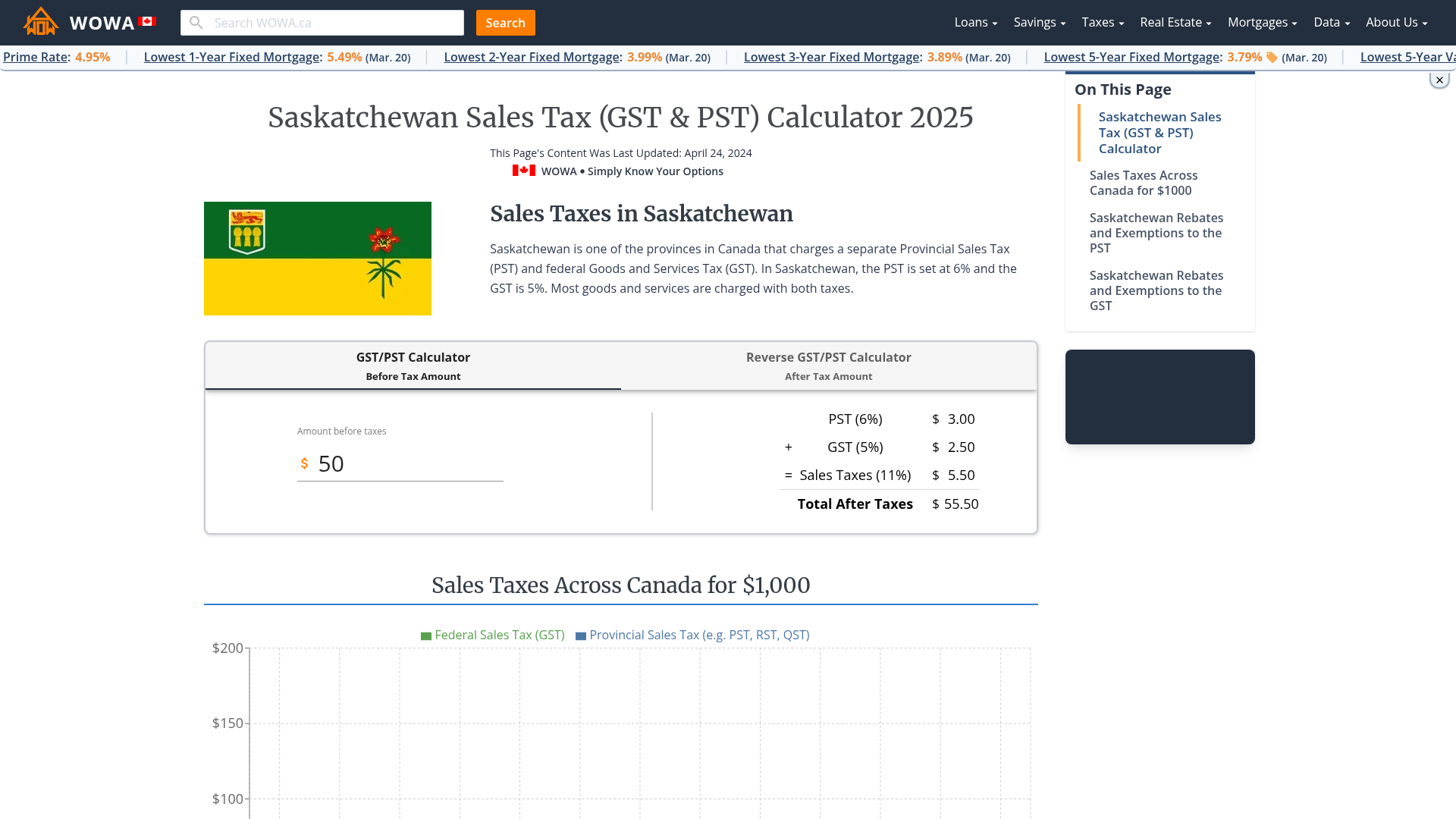

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Corporate Tax Meaning Calculation Examples Planning

Fifa Ultimate Team Tax Calculator Fifplay

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

The Property Tax Equation

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age